Best Business Travel Credit Card: Your Ultimate Guide to Saving Big While Traveling

Traveling for business can be thrilling. You get a chance to explore the world while growing your company with new cities and exciting opportunities. But let’s face it expenses can add up quickly when flights, hotels and meals are involved. Choosing the best business travel credit card is a powerful tool to earn rewards, save on costs and streamline travel expenses.

I have discovered the right business travel credit card that can be a game-changer for someone who is spent years traveling for work. It’s not just about racking up points—it’s about maximizing value, enjoying perks and making every dollar count. Let’s dive into the best options available, their unique features, and why they deserve a spot in your wallet.

Need the best business travel credit card? The Chase Ink Business Preferred® is fantastic for earning rewards with 3x points on travel and business expenses. For premium perks like lounge access, you must-have the luxury Amex Business Platinum Card®. Traveling to Europe? The Capital One Venture Rewards Card is simple and perfect with 2x miles on all purchases and no foreign transaction fees. The Chase Ink Business Cash® offering 5% cashback on office essentials with no annual fee. Small businesses can benefit from it.

No matter your travel style there is a card to save you money and make your trips more rewarding!”

Why You Need a Business Travel Credit Card

A business credit card is more than just a payment method. Business credit card offers valuable rewards, expense tracking and travel perks that can save you time and money. Choosing the best business travel credit card means unlocking benefits like free flights, hotel upgrades, lounge access and cashback. Whether you are a frequent flyer or an occasional business traveler you must have it.

Best Business Travel Credit Card

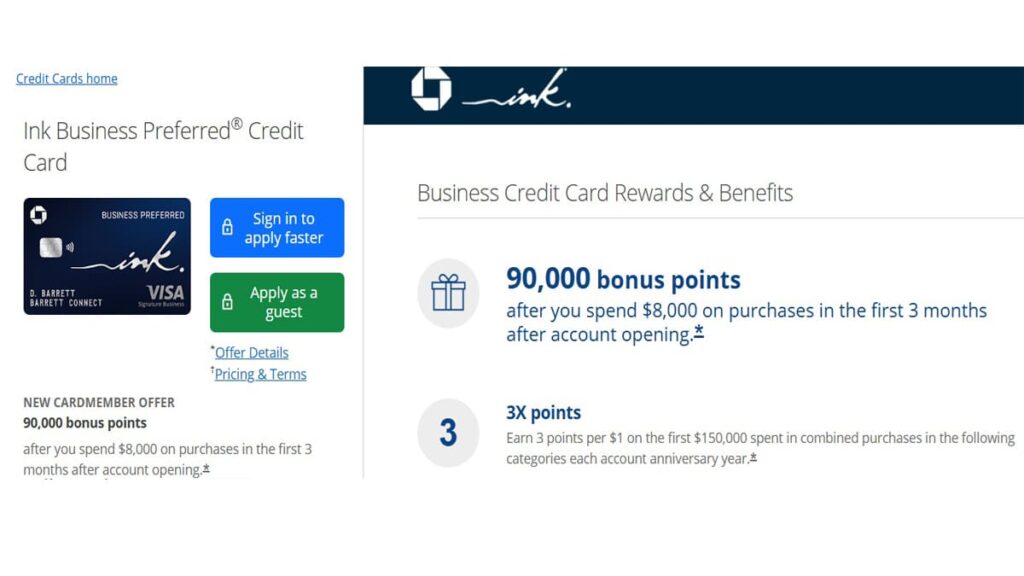

1. Chase Ink Business Preferred® Credit Card

- Why Chase Ink Business Preferred® Credit Card is Amazing: This credit card is a go-to for business owners who want to earn travel rewards quickly. It is one of the best business travel credit cards available with its lucrative sign-up bonus and excellent points system.

- Features:

- Earn 3x points on travel, shipping and select business purchases.

- Sign-up bonus: 100,000 points after spending $15,000 in the first 3 months.

- Points can be redeemed through Chase Ultimate Rewards or transferred to airline and hotel partners.

- Global Acceptance: Widely accepted worldwide making it ideal for international business travel.

- Pros:

- High-value rewards.

- Comprehensive travel insurance benefits.

- No foreign transaction fees.

- Cons:

- $95 annual fee.

- High spending requirement for the sign-up bonus.

Note- T&C can be changed, please refer to brand web site.

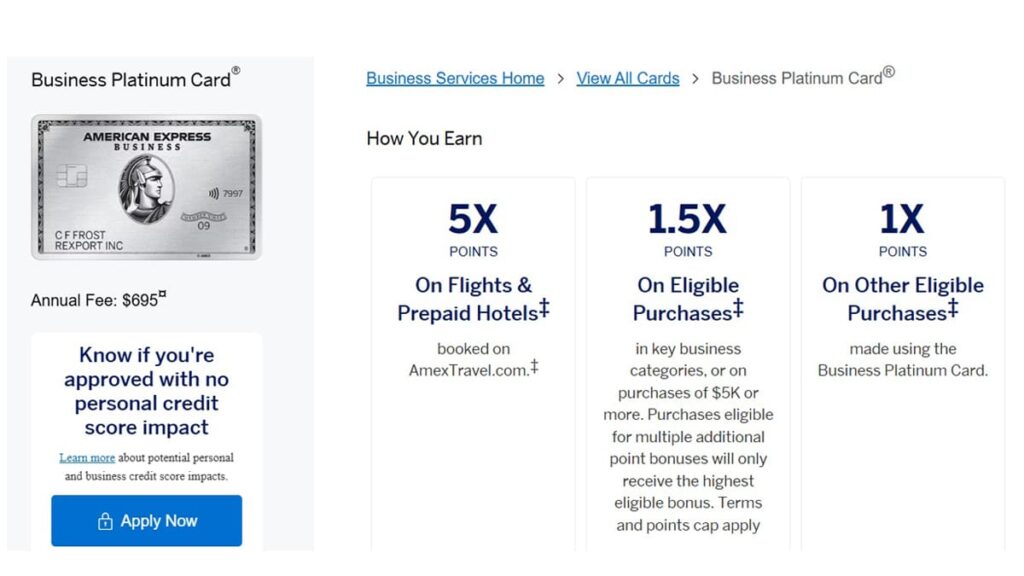

2. American Express Business Platinum Card®

- Why American Express Business Platinum Card® is Amazing: For frequent travelers the Amex Business Platinum is hard to beat. American Express Business Platinum Card® is packed with premium benefits, including lounge access and hotel perks making it a top contender for the best business credit cards with rewards.

- Features:

- Earn 5x points on flights and prepaid hotels through Amex Travel.

- $200 airline fee credit and access to over 1,400 airport lounges worldwide.

- Premium concierge service.

- Global Acceptance: Accepted in most major countries, though some smaller establishments may not take Amex.

- Pros:

- Extensive travel perks.

- Elite status with partner hotels.

- TSA PreCheck/Global Entry fee credit.

- Cons:

- Steep annual fee of $695.

- Rewards are geared towards frequent travelers.

Note- T&C can be changed, please refer to brand web site.

Best Credit Card for European Travel

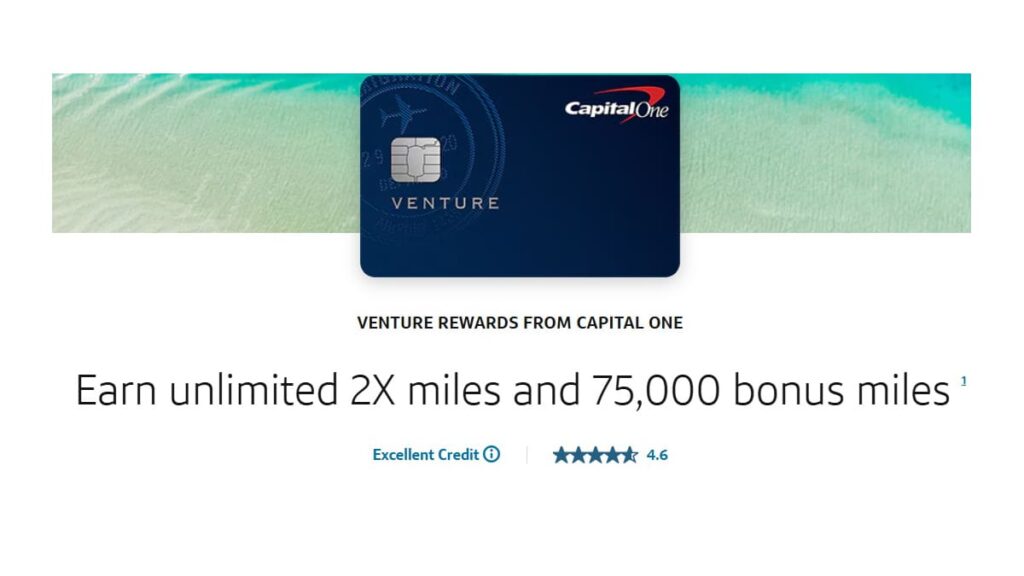

1. Capital One Venture Rewards Credit Card

- Why Capital One Venture Rewards Credit Card is Amazing: The Capital One Venture is an excellent choice for European travel thanks to its simplicity and flexible redemption options. Capital One Venture Rewards Credit Card is one of the best credit cards for travel in Europe because of its no foreign transaction fees and straightforward rewards system making it one of the business travel credit cards.

- Features:

- Earn 2x miles on every purchase.

- Global Entry/TSA PreCheck fee credit.

- Flexible redemption for travel purchases or transfers to airline partners.

- Global Acceptance: Visa’s wide network ensures it’s accepted almost anywhere in Europe.

- Pros:

- Flat rewards rate on all purchases.

- Easy-to-use redemption options.

- Affordable $95 annual fee.

- Cons:

- No premium perks like lounge access.

Note- T&C can be changed, please refer to brand web site.

2. Bank of America® Travel Rewards Credit Card

- Why Bank of America® Travel Rewards Credit Card is Amazing: The Bank of America Travel Rewards card shines if you are after the best no annual fee travel credit cards. It’s simple, cost-effective and perfect for occasional European trips making it best travel business credit card.

- Features:

- Earn unlimited 1.5x points on all purchases.

- No annual fee or foreign transaction fees.

- Redeem points for statement credits on travel purchases.

- Global Acceptance: Widely accepted across Europe.

- Pros:

- No fees.

- Straightforward rewards system.

- Cons:

- Fewer premium perks compared to other cards.

Note- T&C can be changed, please refer to brand web site.

Best Business Credit Card for Travel Rewards

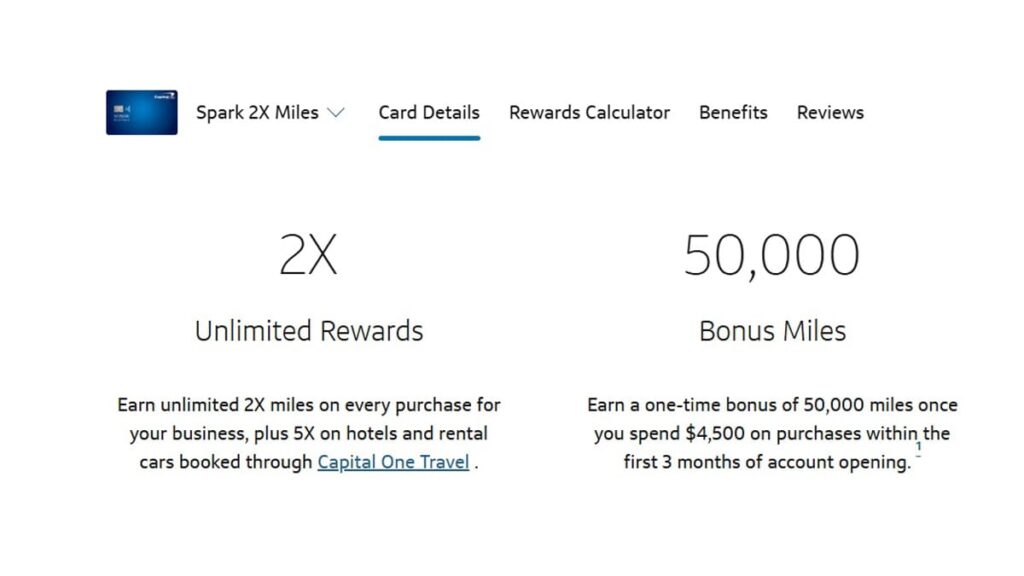

1. Capital One Spark Miles for Business

- Why Capital One Spark Miles for Business is Amazing: The Spark Miles card delivers if you’re looking for the best travel rewards business credit card with no complicated rules. It’s perfect for earning and redeeming miles without restrictions.

- Features:

- Earn 2x miles on every purchase.

- Global Entry/TSA PreCheck fee credit.

- Transfer miles to travel partners.

- Global Acceptance: Widely accepted due to its Visa platform.

- Pros:

- Unlimited rewards.

- Easy redemption process.

- Cons:

- $95 annual fee after the first year.

Note- T&C can be changed, please refer to brand web site.

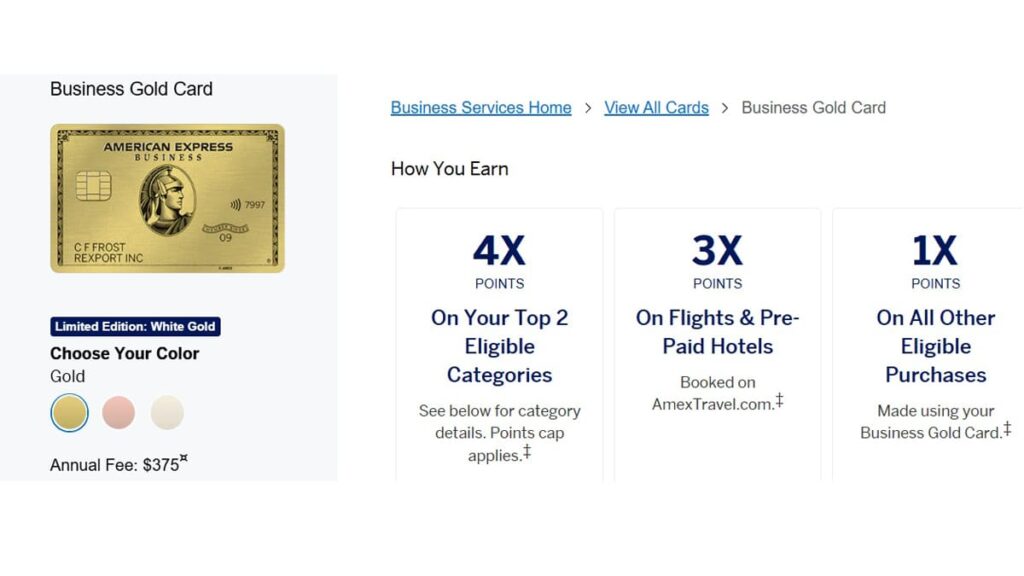

2. Business Gold Card® from American Express

- Why Business Gold Card® is Amazing: Business Gold Card® is designed for entrepreneurs with high rewards in spending categories like travel making it one of the best business credit cards for travel.

- Features:

- Earn 4x points on your top 2 spending categories, including airfare.

- Flexible payment options to manage cash flow.

- Points transfer to travel partners.

- Global Acceptance: Accepted in most countries, though Amex isn’t as universal as Visa or Mastercard.

- Pros:

- High rewards in select categories.

- Strong travel benefits.

- Cons:

- $295 annual fee.

Note- T&C can be changed, please refer to brand web site.

Best Business Credit Cards for Small Business

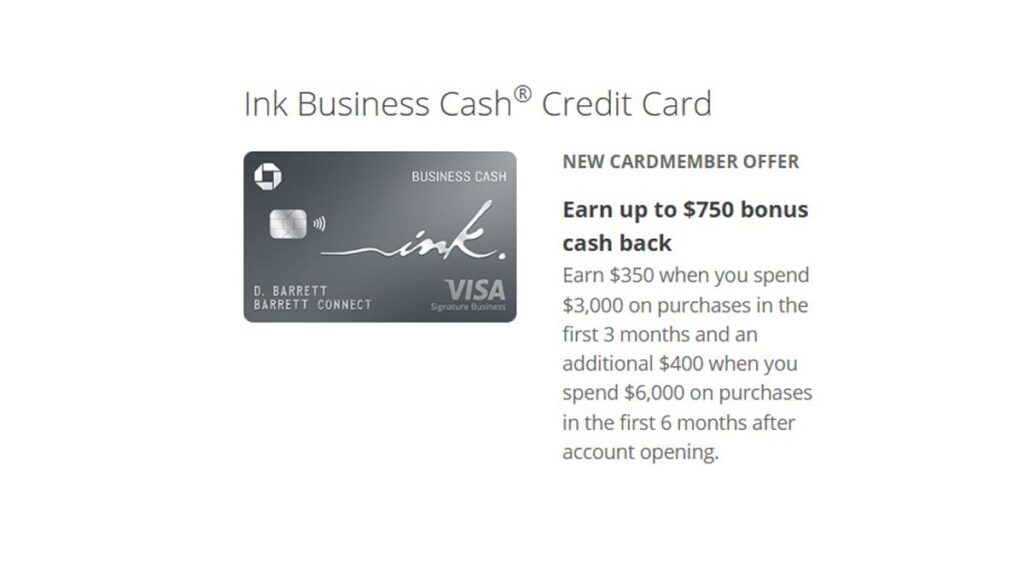

1. Chase Ink Business Cash® Credit Card

- Why Chase Ink Business Cash® Credit Card is Amazing: Small business owners will love the Chase Ink Business Cash for its cashback rewards on common business expenses.

- Features:

- Earn 5% cashback on office supplies, internet and phone services.

- No annual fee.

- 0% intro APR on purchases for 12 months.

- Global Acceptance: Accepted globally, but it has a 3% foreign transaction fee.

- Pros:

- No annual fee.

- High cashback rate on business essentials.

- Cons:

- Not ideal for international travel due to foreign transaction fees.

Note- T&C can be changed, please refer to brand web site.

2. Brex Card for Startups

- Why Brex Card is Amazing: The Brex card is tailored for you if you are running a startup. It offers high rewards and doesn’t require a personal guarantee making it a top pick for best small business credit cards.

- Features:

- Earn up to 7x points on travel booked through Brex.

- No annual fee.

- Built-in expense tracking for your team.

- Global Acceptance: Accepted worldwide through Mastercard’s network.

- Pros:

- Great for startups with no personal liability.

- High rewards in select categories.

- Cons:

- Requires integration with business accounts.

Note- T&C can be changed, please refer to brand web site.

My Experience with Business Travel Credit Cards

I have used several Business Travel Credit Cards over the years while traveling for work. The Chase Ink Business Preferred stands out for its high-value points and easy redemption options. I have used my points for free flights and hotels across Europe and Chase Ink Business Preferred travel insurance benefits have saved me from unexpected costs.

The Amex Business Platinum is unbeatable for premium perks. Lounge access alone has made long layovers more enjoyable and the 5x points on flights helped me score upgrades on international trips.

Conclusion: Finding Your Perfect Business Travel Credit Card

The best business travel credit card depends on your travel habits and business needs. If you want premium perks the Amex Business Platinum is a top choice. For flexible rewards and affordability go for the Chase Ink Business Preferred or the Capital One Spark Miles for Business. Small business owners will appreciate the simplicity of the Chase Ink Business Cash while startups can benefit from the Brex Card.

Choose wisely and your card will do more than just cover expenses. It will elevate your travel experience, save money and reward you every step of the way.

FAQ

What is the best business travel credit card?

The Chase Ink Business Preferred® is an excellent all-around choice for its rewards and flexibility.

Which card is best for European travel?

The Capital One Venture Rewards Credit Card is widely accepted and offers simple, valuable rewards.

Are there no annual fee business credit cards?

Yes, the Chase Ink Business Cash® and Brex Card are great options with no annual fees.

Which card offers the best travel rewards?

The Amex Business Platinum Card® and Capital One Spark Miles for Business are top picks for maximizing travel rewards.

What’s the best business credit card for small businesses?

The Chase Ink Business Cash® Credit Card is ideal for small businesses needing cashback on everyday expenses.